Discover the Acea Group online 2020 Consolidated Report

Acea's 2020

In 2020, despite the challenging context caused by the severe pandemic, we were able to effectively manage the crisis and continued to provide essential services to our citizens, maintaining high levels of efficiency and quality of service even in the most critical months. The results achieved, thanks to the commitment shown by all our people and to our investments in innovation and digitalisation, are growing compared to last year and exceeding the guidance provided to the markets, this testifies a high degree of resilience and an ability to respond to complex situations.

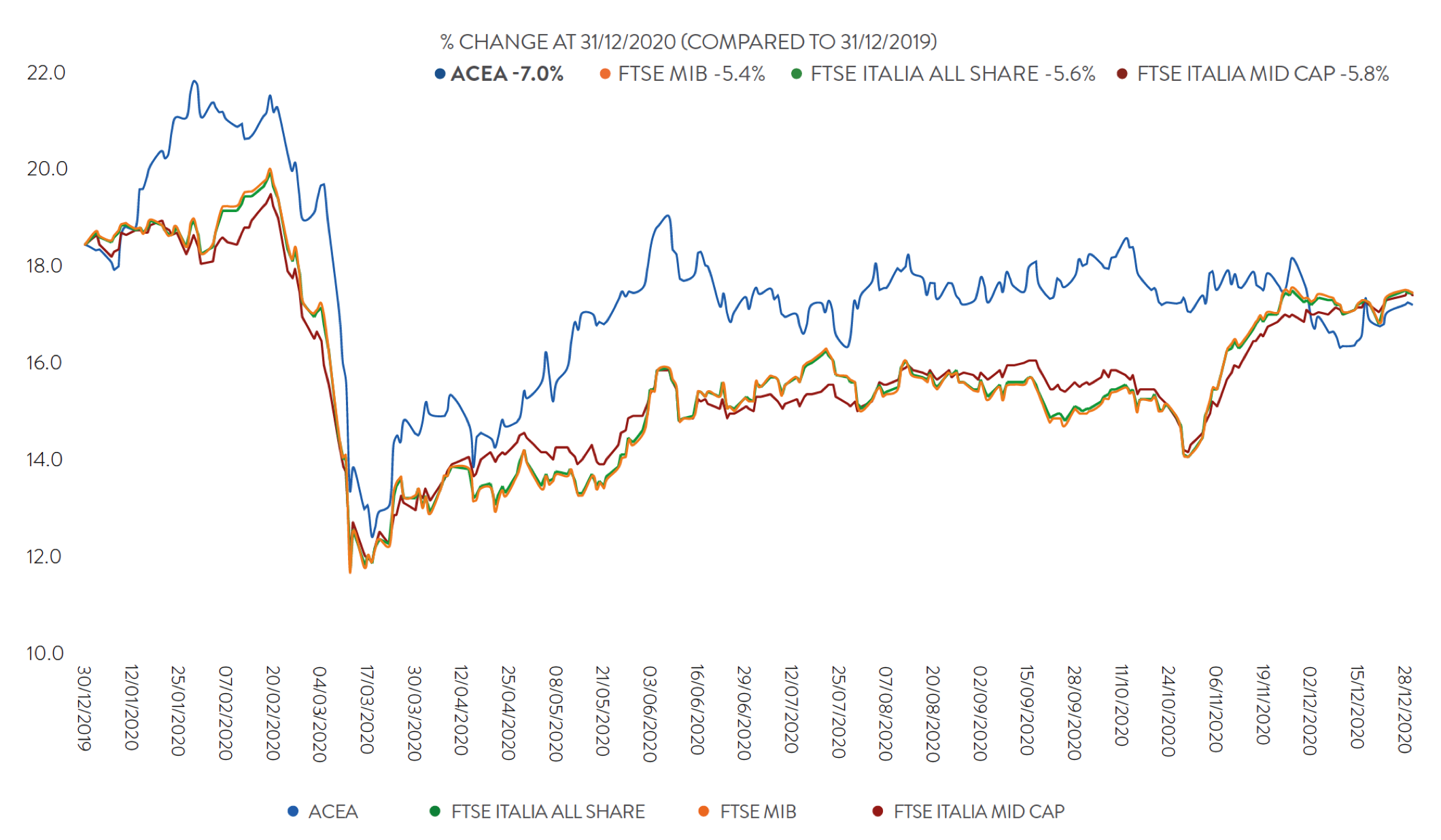

Performance of the equity markets

2020 was a year marked, at the global level, by the significant “health emergency” caused by the spread of COVID-19 which led to the deepest economic recession since the second world war. In this context, the international equity markets recorded divergent trends.

Acea showed performance substantially in line with the Italian market, recording a drop of 7%. The stock recorded on 30 December (last day of opening of the market in 2020) a closing price of € 17.15 (capitalisation: € 3,652.3 million). The maximum value of € 21.8 was reached on 29 January, while the minimum value of € 12.4 was reached on 18 March. During 2020, the daily average volumes were approximately 165,000, slightly higher than in 2019.

Performance of the Acea stock compared to Stock Market indices:

Summary of results

Consolidated revenue grows 6.1% to €3,379.4m. Consolidated EBITDA is up 10.9% to €1,155.5m (€1,042.3m in 2019). The growth is driven by organic growth of over 10%, primarily reflecting the positive performances of our regulated water and electricity distribution businesses. The contributions of the operating segments to consolidated EBITDA, of which approximately 85% is generated by regulated businesses, are as follows: Water 53%; Energy Infrastructure 36%; Commercial & Trading 6%; Environment 4%; other businesses (Overseas and Engineering & Services) and the Holding Company 1%.

L’indebitamento al 31 Dicembre 2019: (i) è esposto al lordo di € 18,7 milioni di crediti riconducibili all’IFRIC12 di Acea S.p.A.; (ii) contiene € 77,1 milioni di debiti per dividendi deliberati e non ancora distribuiti a Roma Capitale; (iii) contiene € 16,3 milioni di crediti relativi all’istanza di rimborso presentata all’AGCM per la restituzione della somma versata a fine anno; (iv) è esposto al lordo di € 17,4 milioni di debiti riconducibili ad alcune acquisizioni di partecipazioni del ramo fotovoltaico avvenute nel corso dell’anno.

Performance of results

- Income statement data

- Financial position and cash flows

| Income statement data (€ million) | 31/12/2020 | 31/12/2019 | Change | % Change |

|---|---|---|---|---|

| Revenue from sales and services | 3,205.3 | 3,021.8 | 183.5 | 6.1% |

| Other revenue and income | 174.1 | 164.3 | 9.8 | 6.0% |

| Costs of materials and overheads | 1,986.9 | 1,936.0 | 50.9 | 2.6% |

| Personnel costs | 267.7 | 249.3 | 18.4 | 7.4% |

| Net income/(costs) from commodity risk management | 0.3 | 0.1 | 0.2 | n.s. |

| Income/(costs) from equity investments of a non-financial nature | 30.3 | 41.4 | (11.0) | (26.7%) |

| EBITDA | 1,155.5 | 1,042.3 | 113.2 | 10.9% |

| Amortisation, Depreciation, Provisions and Impairment | 620.5 | 519.1 | 101.4 | 19.5% |

| Operating profit/(loss) | 535.0 | 523.2 | 11.8 | 2.2% |

| Financial operations | (88.0) | (95.4) | 7.4 | (7.8%) |

| Equity investments | 14.2 | 2.6 | 11.7 | 451.1% |

| Profit/(loss) before tax | 461.2 | 430.4 | 30.8 | 7.2% |

| Income taxes | 134.6 | 123.2 | 11.4 | 9.3% |

| Net profit/(loss) | 326.6 | 307.2 | 19.4 | 6.3% |

| Profit/(loss) attributable to non-controlling interests | 41.6 | 23.5 | 18.1 | 77.1% |

| Net profit/(loss) attributable to the Group | 284.9 | 283.7 | 1.3 | 0.4% |

| Financial position data (€ million) | 31/12/2020 | 31.12.2019 | Change | % Change |

|---|---|---|---|---|

| NON-CURRENT ASSETS AND LIABILITIES | 6,602.20 | 5,825.80 | 776.40 | 13.30% |

| NET WORKING CAPITAL | (750.90) | -656.20 | (94.70) | 14.40% |

| INVESTED CAPITAL | 5,851.20 | 5,169.50 | 681.70 | 13.20% |

| NET FINANCIAL DEBT | (3,528.00) | (3,062.80) | (465.10) | 15.20% |

| Total Shareholders' Equity | (2,323.30) | (2,106.70) | (216.50) | 10.30% |

| Total Sources of Financing | 5,851.20 | 5,169.50 | 681.70 | 13.20% |